Contact

Payroll Unit, Division of Human Resources, SLU

HR-specialists

Division of Human Resources, SLU

As a government agency, the Swedish University of Agricultural Sciences (SLU) is not permitted to employ someone to work in another country.

It is not possible for SLU to employ someone working in a country other than Sweden, whether in their homeland or elsewhere. This rule applies to all Swedish public authorities. Only government agencies operating abroad, such as embassies, consulates and the Swedish International Development Cooperation Agency (Sida) are permitted to employ local staff in another country. An exception can be made in the case of International secondments (URA). Learn more about URA here.

Both the Swedish Agency for Government Employers and SLU advise against working remotely from abroad, as the legal position is unclear with regard to several areas of labour law. Learn more below under the tab: Working remotely from abroad

If an employee is to work abroad part-time for SLU and part-time for another employer, an investigation must be conducted before going abroad, including their social security status. Learn more below under the tab: Employees working in multiple countries for different employers.

Always contact the Division of Human Resources immediately whenever the situations described above arise.

Risks

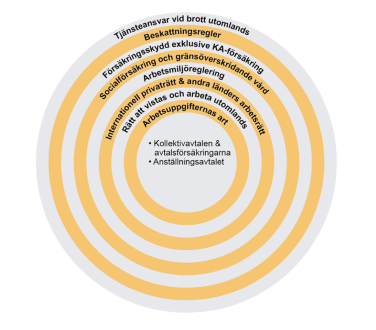

Working abroad presents significant risks to both the individual employee and SLU as their employer:

Both the Swedish Agency for Government Employers and SLU advise against working remotely from abroad, as the legal position is very unclear with regard to several areas of labour law. See above for risks.

When working remotely from abroad, the greatest risk is to the individual employee. The employee may be liable to pay tax in multiple countries, and risk losing collectively agreed benefits such as supplementary parental allowance and sickness benefit. If the employee’s social insurance eligibility is not investigated, the employee also risks being uninsured in both countries should they be injured or fall ill.

As an employer, in such situations SLU is also liable to pay tax, pension contributions and employer contributions in the correct country and to report and deduct tax.

Please note that the above applies if the employee is employed solely by SLU and works for SLU remotely from abroad. If the employee also works part-time for another employer, other rules and procedures apply. In which case, see under the tab: Employees working in multiple countries for different employers

On 22 March 2024, the Swedish Agency for Government Employers concluded a new agreement with OFR/S,P,O, Saco-S and Seko. The new agreement means that the central collective agreement applies to two situations involving working remotely from abroad (in a manner equivalent to working from home in Sweden):

The agreement only applies in the two situations described above, not under any other circumstances.

Please note that even in the two situations described above there are risks associated with working remotely from abroad and doing so is therefore not recommended. These risks include:

Even in the two situations described above, an individual agreement must also be concluded between the manager and employee before remote working can be approved. See the template Individual agreement on working remotely from abroad.

Individual agreement on working remotely from abroad

https://www.forsakringskassan.se

If an employee is to work abroad part-time for SLU and part-time for another employer, an investigation must be conducted to establish their social security status. In such situations, the Division of Human Resources must be contacted immediately so that an investigation can be conducted before employment commences.

If social security status is not established, and social security contributions and tax are paid in the wrong country, SLU may be liable to make payments to the correct country retroactively.

Unclear social security status also poses considerable risks for the employee, who may be liable for tax in both countries, and be without insurance cover for themselves and their family in both countries in the event of injury or illness.

In such circumstances, the head of department/equivalent should consider whether it is appropriate to grant part-time leave of absence, in which case a more detailed investigation must be conducted than that for working remotely from abroad. This investigation can often involve a consultancy fee payable by the department.

If the employer is registered as a resident of Sweden, they can apply to the Swedish Social Insurance Agency (Försäkringskassan) for certificate A1. If the employer is registered as a resident of another country, they can apply to the equivalent agency in that country for the certificate.

https://www.forsakringskassan.se

The investigation may result in SLU needing to register its operations in the other country in order to correctly pay employer contributions. This is dealt with and decided on by the Legal Affairs Unit.

Be alert in case a prospective part-time employee has their residence abroad.

Also be alert in case an employee applies for part-time leave of absence to take up another part-time position abroad. Ask for a copy of the employment contract and consult an HR specialist.

SLU may engage the services of external experts who live in another country. External experts are fee-remunerated and perform only short-term work. This work is considered to be largely performed in Sweden, such as when attending trial lectures.

External experts who reside abroad and are employed for less than six months should apply to the Swedish Tax Agency for special income tax for foreign residents (SINK). All necessary documentation for remunerating the external expert should then be sent to the Payroll Unit. Learn more about SINK here.

The external expert will also need a coordination number before they can be paid. The department requests coordination numbers from the Swedish Tax Agency on behalf of external experts. If the external expert is abroad and unable to visit a Swedish Tax Agency office, they will be assigned a coordination number with the identity level “probable”. Learn more about coordination numbers here.

Payroll Unit, Division of Human Resources, SLU

HR-specialists

Division of Human Resources, SLU